June 4, 2017

Being process driven, I really see the benefits in measuring things I want to improve. One thing I like to manage is my finances (especially with my goal of hitting financial independence), and I have definitely found truth in the old mantra “If you don’t measure it, you can’t manage it”. This post details the process I follow, and includes some templates if you want to follow the same.

First off, I know there are a lot of automatic tools out there with many bells and whistles but I was looking for a few things:

- I want to actually record the expenses myself when they happen as it helps me to be more mindful of them. This was the most important factor for me.

- I want the tool and process to be simple and easy to follow.

- I do not want to connect my bank accounts to a service (especially one that is free). Besides, European banks are a bit behind North America so at the time of writing this is not possible for all of my accounts.

- I want to be able to slice and dice the data how I want.

- If you are different and want to use a pre-built tool (and one that gives you a good money management approach to follow), I’d recommend You Need a Budget based on my research.

My process

Anytime money comes in or money goes out, I record it using a Google Form. I have this form saved on the homescreen of my phone and favourited in every browser I use so it is easily accessible. The form looks like this:

![]()

Categories include the following:

- Income

- Groceries

- Eating/Drinking out

- Rent and Utilities

- Transport

- Health services

- Entertainment

- Fees and charges

- Learning

- Material things

- Gifts

- Other

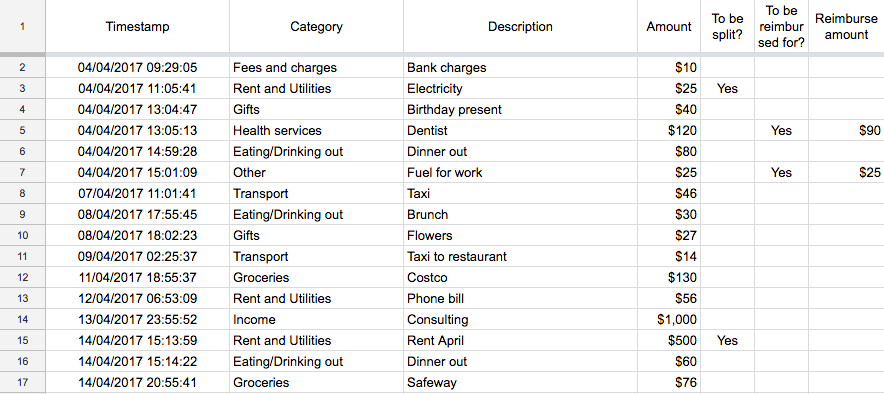

The “To be split?” checkbox allows me to tag something if I’m splitting the cost with my partner (e.g. rent) and the “to be reimbursed for?” checkbox is used where I should be reimbursed down the road (e.g. an expense in work or health insurance claim).

I review the use of the “Other” category now and again and add additional categories based on it if necessary.

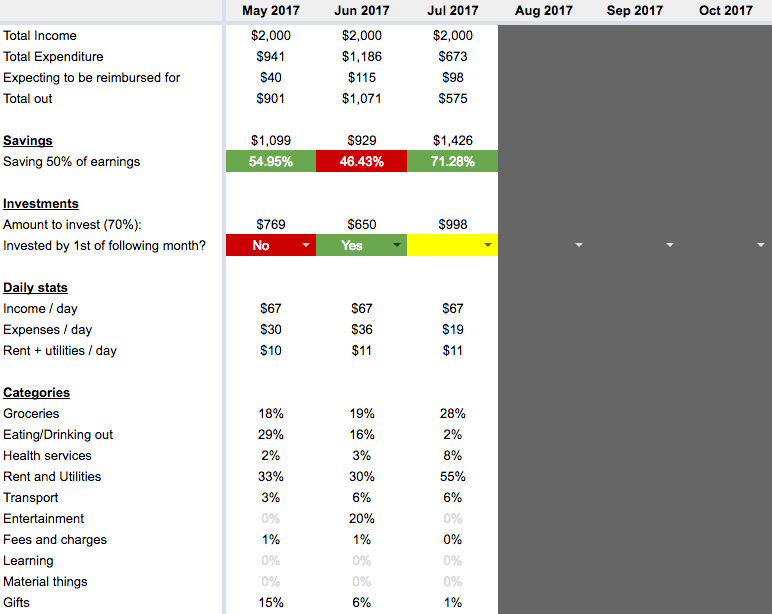

The responses of this form are sent into to a Google Sheet. It has two main tabs; (1) the raw submissions from form entries and (2) a monthly analysis. They look like this:

Form Submissions:

Note: This is dummy data.

Monthly Analysis:

Note: Again, this is dummy data.

A few points on the analysis tab:

- There is conditional formatting to show when things are going well (green) and poorly (red).

- I set a target savings rate and a target investment rate in another tab called “Info & Settings”. This then triggers the colours for the % savings (e.g. red < my target, green > my target) and calculates the amount I should be investing.

- If you are unsure what your target savings should be, I’d recommend you read this and this and then calculate your savings rate here.

How you can do the same

- Set up a Google Form to record your expenses (you can grab a sample copy of mine here)

- Make a copy (File > Make a copy…) of the spreadsheet here

- Link your Google Form responses to go into the first tab of the spreadsheet you copied.

- Update the savings and investment rate to whatever you want in the “Info & Settings” tab.

- Save the link to the Form on your phone and desktop and start using it!

I hope you find this useful. If you start using it and have any questions or feedback, make sure to get in touch! I’m available on LinkedIn or Twitter @BrianTVH.